Deductible Business Expenses 2024 Tax – According to the IRS, though, an audit is simply a review of your accounts “to ensure information is reported correctly according to the tax laws and to verify the reported amount . On January 31, 2024, the United States House of Representatives passed the Tax Relief for American Families a taxpayer is generally able to deduct interest expenses attributable to its trade or .

Deductible Business Expenses 2024 Tax

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax Deduction Definition: Standard or Itemized?

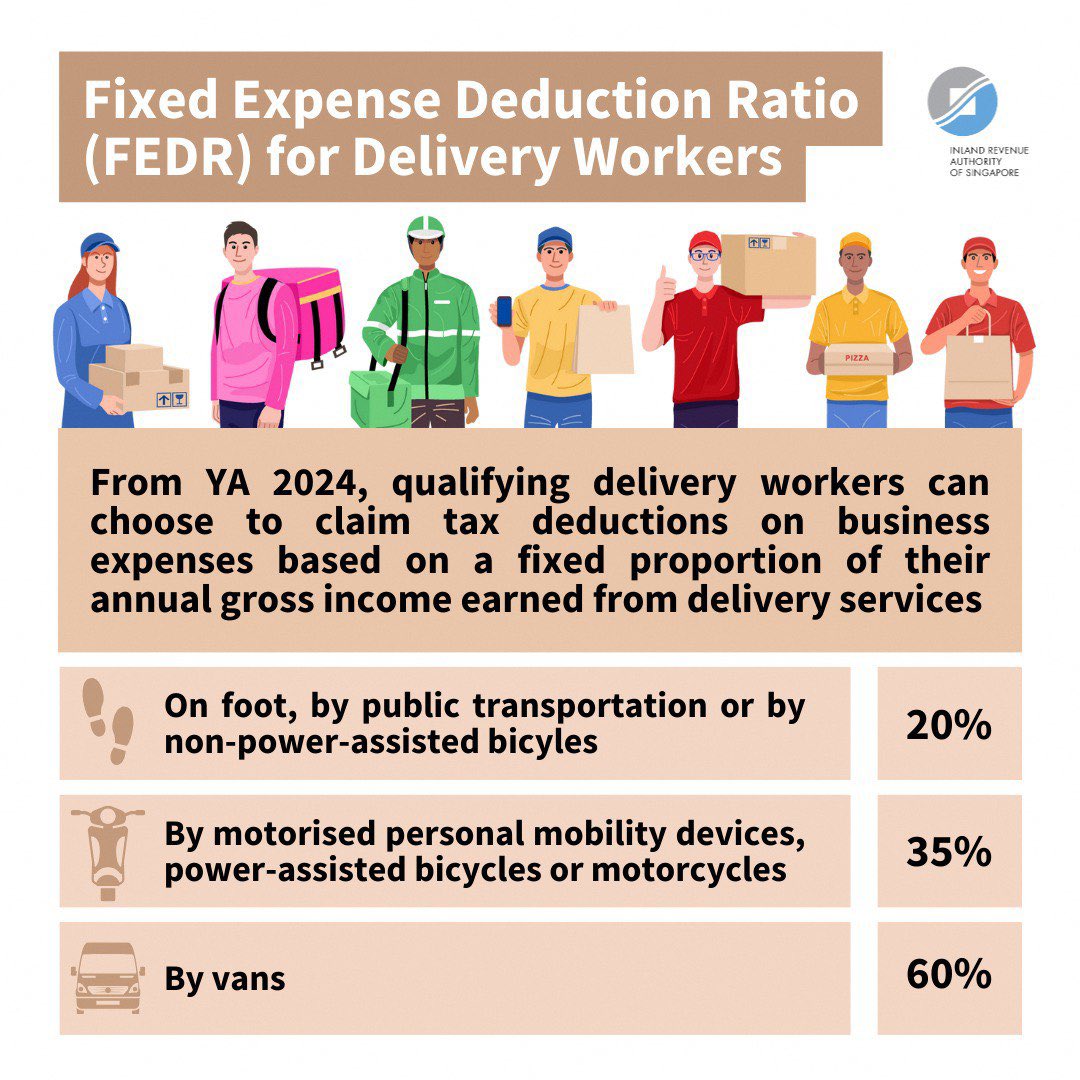

Source : www.investopedia.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.com🚀 Elevate your freelance game Freelancers in Belgium | Facebook

Source : m.facebook.comDeductible Business Expenses 2024 Tax 25 Small Business Tax Deductions To Know in 2024: Ready or not, the 2024 tax filing season is Among them are higher standard deduction amounts, expanded income tax brackets and changes to business deductions. When filing your taxes, you . W ith its homeowner tax breaks and perks, tax season is one of the few times you can get some cash out of your house instead of pouring money into it. With the steady climb of hom .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)